CREDITO — building a Credit Intelligence Network

C redeemed. This is a project powered by block chain technology. The project is focused providing people better usage of crypto currency. They are using smart contracts on Ethereum network with ERC 20 compatible tokens. Tokens which are made for purpose of these project. Founders of Credito wanted to achieve that everyone could trace transactions. With this new platform, which is decentralized we will be able to track transactions, credit scores and many more. The market is suffering huge losses of hundreds of billions of dollars a year because of the exploitation of others work. There are many frauds and they are hard to trace. They have found a solution for this. Their goal is to create marketplace where you will have an ability to lend or maybe borrow some funds. There will be no third person involved, just those one who borrow and lend. Their communication will be better and faster. They can reach each other faster at any time, where they go, and the costs are lower. It will bring a revolutionary things in these field.

Credito Design Principles and Values

Decentralization.

Secure, transparent and extensible systems.

Modularity for simple and flexible system design.

Secure, transparent and extensible systems.

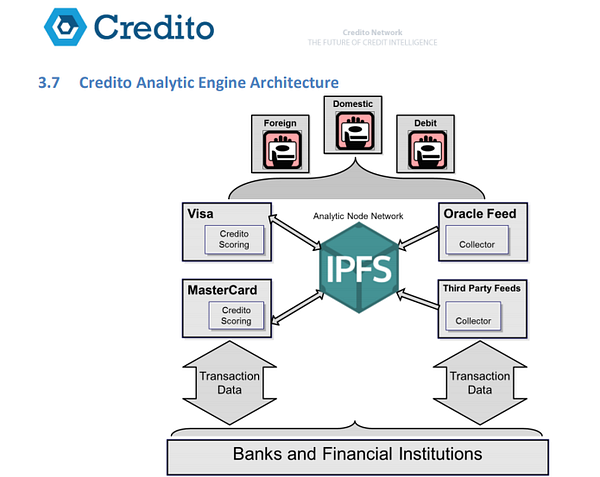

C redito is a decentralized credit intelligence network that provides credit scores, transaction values and loan markets supported by the Ethereal block, Intelligent Contracts and IPFS, which increases transparency and reliability.

Credit Solution

Asa solution to the above problems, we have created the Credito Network, or simply Credito. A decentralized network based on Ethereum blockchain coupled with smart contracts and Interplanetary File System (IPFS) providing Credit Intelligence and Decentralized Lending Marketplace.

Decentralization through the use of Smart Contracts also removes any trust requirement between borrowers and lenders, providing a trustless and transparent lending environment unavailable in today’s market.

Smart Contracts achieve this through their pre-defined parameters removing the need for trust between participating parties. They are also entirely transparent and viewable by anyone using an Ethereum blockexplorer.

Decentralization through the use of Smart Contracts also removes any trust requirement between borrowers and lenders, providing a trustless and transparent lending environment unavailable in today’s market.

Smart Contracts achieve this through their pre-defined parameters removing the need for trust between participating parties. They are also entirely transparent and viewable by anyone using an Ethereum blockexplorer.

Credito is Transparent

Credito Loan Agreements are Smart Contracts

Credito is “Trustless”

Credito is a project made by people who are highly competent. People who have with their knowledge and with a help of their people in team succeeded to make it happen. Team leader is Srikar Govindarajula . In the team with great block chain developers, marketing agents, SEM experts, and more others.

Credito Loan Agreements are self-enforcing agreements with the terms of the agreement between the Lender and the Borrower, directly written in lines of code, which improves transparency and reliability. The code and chords it contains exist on a decentralized network of decentralized block strings. Credito Loan Agreements allow transactions and agreements of trust to be concluded between disparate and anonymous parties without the need for a central authority, legal system or external enforcement mechanism. They make transactions traceable, transparent and irreversible

Credito is “Trustless”

Credito will avoid the risks associated with third parties and eliminate the need to trust the counterparty. When the borrower files the loan application on Credito Network, the counterparty can not manipulate or stop the loan application once the loan is deployed.

Credit scores aim to derive the investor’s investment and the borrowers’ credit score. Credito scores are generated by Credito Analytic Engine, a self-learning algorithm using a continuous feedback loop using Big Data Analytics, Machine Learning and Artificial Intelligence, offering a score that acts as a dynamic probability marker. reimbursement of a person. loan amount, which evolves with the loan repayment file of the client.More about Credito :

Website: https://credito.io/

Whitepaper : https://credito.io/pdf/whitepaper.pdf

Announcement: https://bitcointalk.org/index.php?topic=2483679.0

Facebook: https: // www. facebook.com/CreditoNetwork

Whitepaper : https://credito.io/pdf/whitepaper.pdf

Announcement: https://bitcointalk.org/index.php?topic=2483679.0

Facebook: https: // www. facebook.com/CreditoNetwork

Twitter: https://twitter.com/CreditoNetwork

LinkedIn: https://www.linkedin.com/company/credito-network

LinkedIn: https://www.linkedin.com/company/credito-network

Author: pring

Bitcointalk Link Profile: https://bitcointalk.org/index.php?action=profile;u=1700150

Ethet Wallet Address: 0x71c68782ab6148d3f4F25ffbFcfdF72423dAa6AC

Tidak ada komentar:

Posting Komentar